How Basetax Uses AI to Simplify Tax Filing and HMRC Compliance in the UK

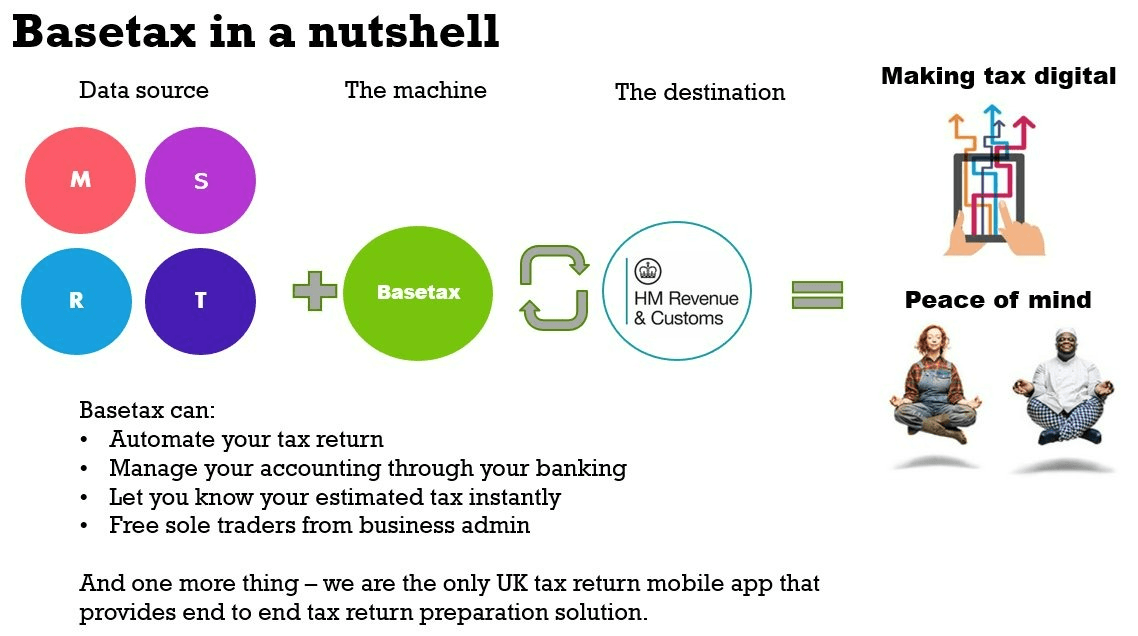

Basetax leverages intelligent AI to automate bookkeeping, forecast liabilities, and file directly with HMRC. It is an end-to-end digital tax solution for individuals, sole traders and small businesses.

The challenge of managing tax obligations in the UK is compounded by the constantly evolving tax guidelines and policies. With regular updates to tax laws, new compliance requirements, and changes in available deductions, staying on top of these fluctuations can be a daunting task. Navigating HMRC forms, figuring out what can be claimed as a deduction, and ensuring compliance often involves a steep learning curve.

According to a survey by GoSimpleTax, nearly 17% of self-employed individuals in the UK were unaware of the government’s Making Tax Digital (MTD) initiative, even as it was set to become mandatory for many from April 2026.

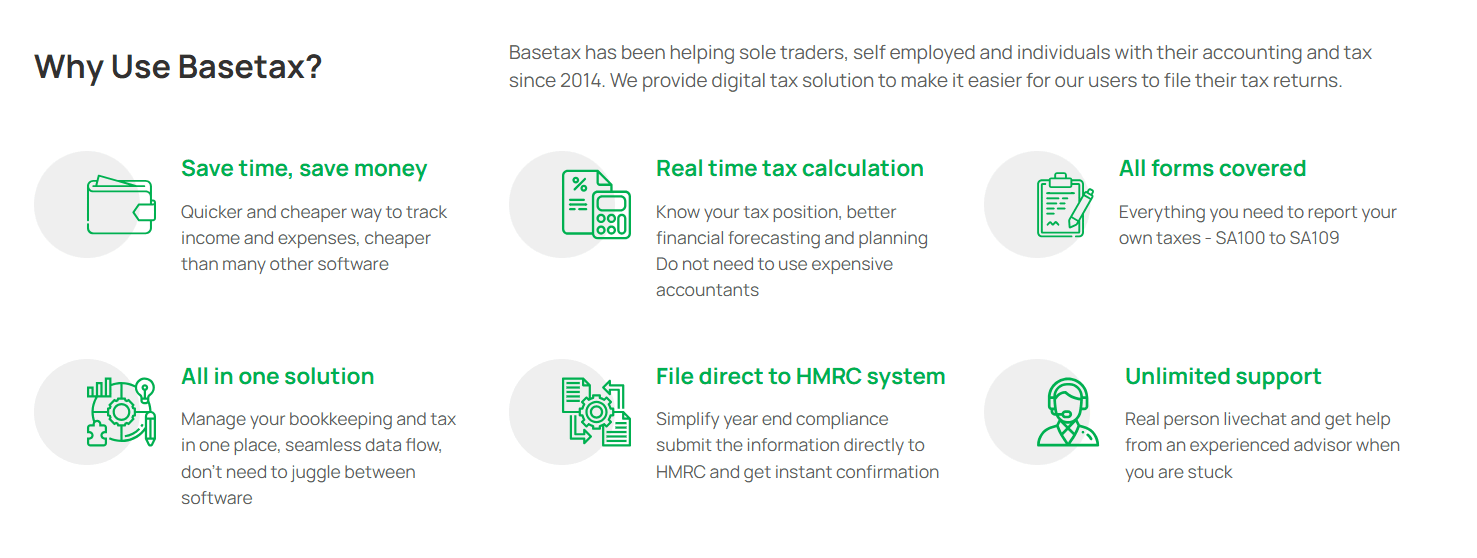

However, Basetax, a UK-based digital tax solution provider, is making this entire process easier, more efficient, and clearer by combining technology with professional advice. Since its start in 2014, Basetax has offered an all-in-one platform designed to simplify tax filing, bookkeeping, and accounting, especially for those outside the traditional corporate framework.

What makes Basetax unique? Along with a simple user interface and dependable customer support, the company is using Artificial Intelligence (AI) to change how individuals and small businesses engage with the UK’s tax system, especially in line with HMRC’s digital transformation efforts.

Basetax: Mission and technology

Basetax was founded to simplify tax management for freelancers, sole traders, and small businesses across the UK. The company’s platform provides a range of services that make tax filing, bookkeeping, and accounting easier for non-experts. Users can track income, expenses, and file tax returns directly with HMRC. Basetax offers a cloud-based solution that can be accessed from anywhere.

The platform’s key features include:

- Bookkeeping software: This helps track income and expenses, generate reports, and connect with bank accounts to simplify financial management.

- Direct tax filing: This feature allows users to submit their tax returns directly to HMRC, providing real-time calculations.

- Accountancy assistance: Users can choose from self-service tools or access qualified accountants if they need extra support.

Basetax stays fully compliant with UK tax regulations as a registered tax agent with Her Majesty’s Revenue and Customs (HMRC). By combining user-friendly tax software with personalised advice, Basetax helps individuals and small businesses manage the complexities of the UK’s tax system easily.

How Basetax is leveraging AI in HMRC

Basetax is using AI to provide a smarter way to manage taxes that supports HMRC’s ongoing digital changes. Here’s how AI fits into Basetax’s services:

1. Real-time tax forecasting and risk mitigation

One of the biggest advantages of AI is its capability to process large amounts of data and offer predictive insights. Basetax employs AI algorithms to give real-time tax forecasts, letting users see their likely tax liability before the year ends. This feature helps freelancers and small business owners plan their finances more effectively. Additionally, AI can highlight potential issues, such as unusual expense claims or discrepancies, helping users avoid HMRC inquiries or audits.

2. Automated bookkeeping and expense tracking

Manually tracking every receipt and expense can be tiring, especially for those with many transactions. AI eases this burden by automating much of the process. Basetax uses machine learning to automatically categorise transactions and sync them with users’ bank accounts, ensuring accuracy and lowering the risk of human error. For example, AI can learn from previous transactions and identify common categories (like travel expenses and office supplies), simplifying the bookkeeping process.

3. Direct HMRC filing with AI checks

As part of its connection to HMRC’s digital tax systems, Basetax allows for direct filing of tax returns. AI helps ensure the accuracy of these returns by checking that all necessary information is included and correct before submission. This AI-driven verification process greatly reduces the risk of mistakes, ensuring that tax returns meet HMRC regulations. If the system spots any issues (like missing forms or incorrect data), it prompts users to fix them before submission.

4. Personalised tax insights and guidance

Basetax’s AI system doesn’t just automate tasks; it also learns from user data to offer personalised tax advice. For instance, the system can suggest ways to lower a user’s tax burden based on their financial situation. If a user frequently overclaims on certain expenses, AI can help them spot patterns that may cause problems with HMRC. By providing real-time guidance, AI keeps users prepared and avoids surprises at year-end.

5. Live chat support powered by AI

While Basetax provides support from human accountants, AI is also used to improve customer service. Through live chat, AI-powered bots can answer common questions, guide users through the platform, and resolve typical issues. This integration allows Basetax to offer round-the-clock support without raising overhead costs.

Why This Matters for You (and SMEs)

For small business owners and freelancers, Basetax’s AI-powered platform offers real benefits:

1. Time and stress savings

AI takes care of many manual tasks related to bookkeeping and tax filing. This gives business owners more time to focus on their work. There’s no need to worry about whether you’ve completed the right forms or classified your expenses correctly.

2. Improved accuracy and reduced risk

Automating key processes and providing real-time insights helps reduce errors that could lead to fines or penalties from HMRC. Automated checks and tax forecasting also support users in staying compliant and avoiding costly mistakes.

3. Better financial planning

AI-powered tax forecasting allows users to plan for their tax liabilities in advance. This decreases the likelihood of unexpected surprises. Whether you are dealing with fluctuating income or taking on new projects, AI provides tools to keep you ahead of your finances.

4. Affordable and accessible

Basetax’s pricing model includes a free plan and reasonably priced premium options. This ensures that small businesses and freelancers can access strong tools without overspending. The platform’s AI-driven automation offers high value at a low cost compared to traditional accountants.

5. Convenience and flexibility

With Basetax’s cloud-based platform, users can manage their taxes and finances from anywhere at any time. This flexibility is particularly valuable for freelancers and small business owners who need to handle multiple tasks and prefer a digital-first approach.

Future of tax management

Basetax’s use of AI in its platform is a major shift. It changes the often complicated process of tax filing into a smoother, more accurate, and easier experience. By automating essential tasks, providing real-time insights, and giving personalised advice, Basetax helps users stay compliant without stress.

With its AI features, Basetax not only makes tax management easier but also equips users to plan for the future, lower their tax burden, and prevent costly errors. As HMRC progresses with its digital changes, Basetax leads the way in helping small businesses handle the evolving tax environment.

For anyone seeking a simpler, smarter method for managing tax filings, Basetax is the future. It’s digital, driven by AI, and fits well with HMRC’s goal for a fully digital tax system.