Basetax: The Smart and Simple Way to File Taxes Online

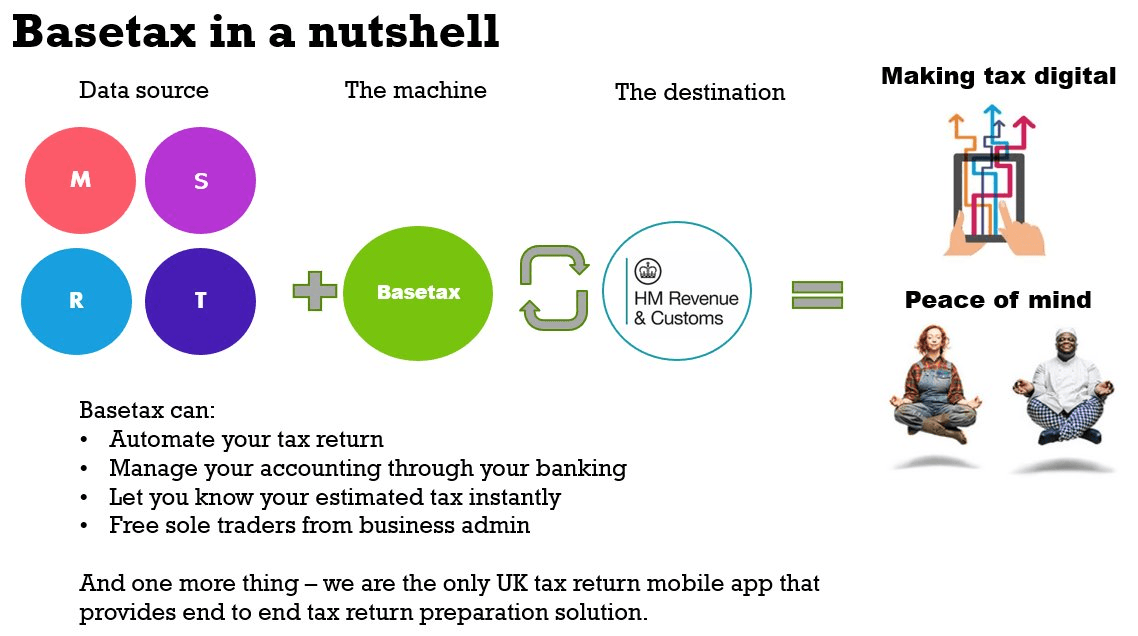

Basetax provides digital tax and accounting solutions for sole traders, self-employed individuals, and small businesses. The platform simplifies bookkeeping and enables users to file tax returns directly to HMRC efficiently, with optional support from qualified accountants.

Basetax, based in London, is a leading digital tax solution provider designed to make tax filing effortless, accessible, and affordable. By combining intelligent cloud-based software with personalised accountant support, the company bridges the gap between automation and human expertise.

Across the United Kingdom, more individuals and businesses are turning to technology to stay compliant and efficient in their tax processes. This shift has been accelerated by the government’s Making Tax Digital (MTD) initiative, launched by Her Majesty’s Revenue and Customs (HMRC) to transform the UK’s tax system into one of the most digitally advanced in the world.

According to HMRC, over 5.5 million self-employed individuals and 2 million small businesses are now required to keep digital records and file tax returns online. This shift represents one of the biggest transformations in the UK’s financial ecosystem, demanding that taxpayers adopt tools and systems that simplify compliance while ensuring accuracy and transparency.

Whether it’s a freelancer filing a self-assessment return or a small business managing VAT and payroll, Basetax helps users navigate the entire process smoothly, keeping them fully compliant with HMRC’s MTD requirements while saving them valuable time and money.

What is Basetax?

Basetax is a UK-based tax service provider that specialises in helping individuals, freelancers, partnerships, and small businesses manage their taxes digitally. Founded in 2014 by Kah Tan and headquartered in London, the company offers an all-in-one platform that combines bespoke tax software with expert accountant support. Its goal is simple yet powerful: to make tax filing as easy as online shopping.

As a registered tax agent with HMRC, Basetax operates within the highest compliance standards. The platform enables users to prepare, review, and submit tax returns directly to HMRC in just a few clicks. From tracking expenses and generating invoices to calculating taxes and submitting self-assessment forms, Basetax ensures that users can handle every step of the tax process through a single interface.

What makes Basetax stand out is its dual model. Users can either file their taxes themselves through its guided self-service tools or opt for the Assisted Filing Plan, where qualified accountants take care of the entire process, from reviewing financials to submitting final returns. This flexibility appeals to both confident self-filers and those who prefer expert oversight.

The platform’s design is particularly tailored for the UK’s self-employed economy, including freelancers, contractors, landlords, and small enterprises that may not have in-house finance teams. Basetax’s cloud-based architecture allows users to access their data anytime, anywhere, on a desktop or via a mobile app. Its real-time tax calculation engine helps users predict their tax obligations in advance, reducing the stress of year-end surprises.

Basetax’s mission focuses on three key pillars:

- Accessibility: Making professional-grade tax solutions available to everyone through easy-to-use digital tools.

- Affordability: Offering transparent pricing with no hidden fees or long-term contracts.

- Compliance: Ensuring every user meets HMRC’s latest standards, including Making Tax Digital (MTD).

The vision behind Basetax goes beyond just providing tax software. The company aims to be the leading digital tax partner for the UK’s growing population of self-employed professionals and small business owners. In an economy where over 15% of the workforce is now self-employed, Basetax envisions a future where managing taxes is as simple as managing an email inbox, intuitive, automated, and error-free.

Basetax also aligns its long-term strategy with the UK’s digital transformation goals. As the government continues to expand MTD to cover more tax categories, Basetax’s platform evolves in real-time to meet new compliance requirements.

History of Basetax

Basetax was founded by Kah Tan, a Chartered Accountant and entrepreneur, with a clear mission: to make accounting and tax management simpler and more accessible for small business owners, freelancers, and self-employed individuals. Kah’s career spans investment banking, professional accountancy, and entrepreneurship, giving him a unique perspective on the challenges faced by businesses of all sizes.

He began his professional journey in investment banking, holding positions at Barclays and RBS, where he developed deep expertise in finance, business strategy, and regulatory compliance. Later, he pursued a career in accountancy, establishing his own firm and supporting over 1,000 clients across a wide range of industries. Through this work, Kah gained a front-row view of the complexities of bookkeeping, tax filing, and compliance for small business owners.

In parallel, Kah explored his entrepreneurial side by building and managing ventures in the food and beverage sector, including a chain of bubble tea shops and a modern food court. These experiences gave him first-hand insight into the daily struggles of small business owners. He observed how hard they worked, yet they were often overwhelmed by accounting tasks, chasing invoices, missing deadlines, and worrying about VAT.

While supporting clients as an accountant, Kah noticed that existing software solutions like Xero, QuickBooks, and Sage were either too complex for business owners or too limited for accountants. They did not truly understand each business; they simply collected data. He realised that what was missing was a system that could combine the precision of technology with the understanding of a human accountant.

This insight led to the creation of Basetax, a smart accounting and tax platform that automates routine tasks, learns from users’ habits, and explains finances in simple language. Since its launch, Basetax has grown into a trusted digital solution, helping freelancers, sole traders, landlords, and small businesses across the UK manage their finances efficiently, stay compliant with HMRC regulations, and focus on growing their businesses.

Basetax reflects Kah Tan’s dual expertise as both an accountant and an entrepreneur, bridging the gap between financial accuracy and practical business needs. It is not just a software platform but a comprehensive digital partner designed to support the next generation of small business owners.

What makes Basetax different?

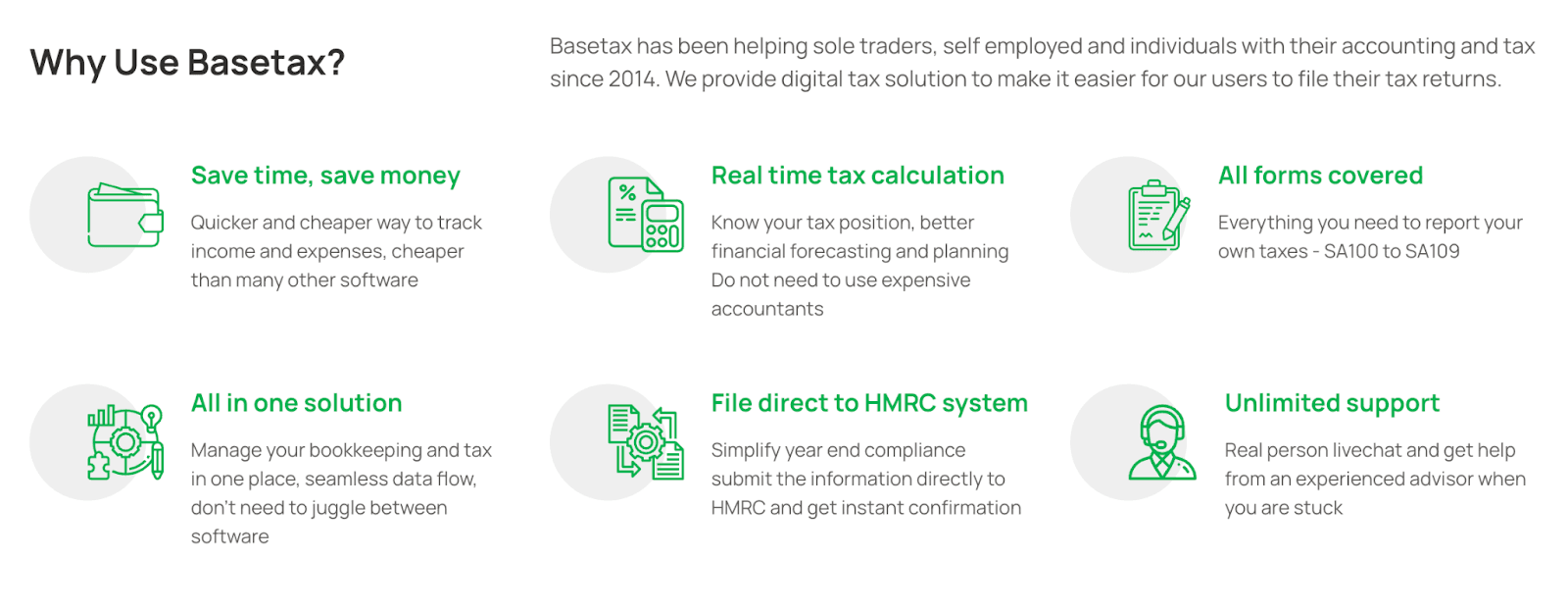

In the crowded landscape of digital accounting and tax software, Basetax distinguishes itself through its blend of automation and human expertise. Many platforms focus solely on self-service models, leaving users to interpret complex tax laws on their own. Basetax, however, combines smart software with real accountants who offer personal guidance whenever required.

1. Designed for the UK’s Self-Employed and Small Businesses

Unlike global platforms that cater to a broad audience, Basetax has been built specifically for UK taxpayers. Every feature, from tax calculations to HMRC integration, is tailored to meet UK regulations, making it particularly suitable for freelancers, contractors, and small enterprises. The interface is written in simple, clear English, ensuring that users don’t get lost in financial jargon.

For example, a freelance designer or a landlord doesn’t need to understand every detail of tax codes. Basetax breaks everything into understandable steps, explaining deductions, allowable expenses, and submission deadlines. This user-centred design is what gives Basetax its reputation as one of the most approachable and reliable tax software solutions in the UK.

2. Transparent and Flexible Pricing

Another major differentiator is Basetax’s affordable pricing structure. Many accounting tools charge hidden fees or require ongoing subscriptions. Basetax offers a clear, upfront pricing plan with no surprises, allowing users to pay only for what they need.

For example, those filing simple self-assessment returns can opt for the low-cost self-service option, while businesses with more complex needs can choose the fully managed plan that includes accountant support.

3. Seamless HMRC Integration

Compliance is at the heart of Basetax’s offering. The platform is fully integrated with HMRC’s digital systems, allowing users to submit their tax returns directly from their Basetax account. There’s no need for third-party uploads or manual paperwork. The system automatically ensures that all data formats align with HMRC’s latest requirements.

Additionally, Basetax provides real-time status updates after submission, so users know exactly when their return has been received and approved. This transparency eliminates uncertainty and helps users stay in control of their finances all year round.

4. Built-In Accountant Support

The most defining feature of Basetax is its on-demand accountant support. Users can get help from qualified professionals who review their returns for accuracy before submission. This means fewer errors, lower chances of penalties, and greater peace of mind.

Whether you’re unsure about allowable deductions or confused about VAT registration, Basetax’s experts can step in with clear, personalised advice. This hands-on support sets Basetax apart from competitors that offer only automated systems without human touchpoints.

Products and services of Basetax

Basetax offers two primary categories of solutions, Software and Accountant Services, designed to make tax management effortless for individuals, freelancers, and small businesses. Each service is crafted to align with HMRC’s Making Tax Digital (MTD) requirements, ensuring full compliance while giving users complete control over their financial records.

1. Software

Basetax’s software suite is built for simplicity. It brings together everything a self-employed professional, landlord, or small business owner needs to manage taxes — from digital bookkeeping to VAT submissions. Users can track income, file returns, and maintain records online, all from one intuitive platform.

Each software service is available at a clear, affordable rate — with no hidden fees and no long-term contracts.

Personal Tax Filing

Designed for freelancers, contractors, and individuals, this service allows users to file personal tax returns directly with HMRC.

The process is guided step-by-step: Basetax helps you input your income, claim eligible expenses, and calculate your total tax due before securely submitting your return. Once filed, you receive instant confirmation from HMRC, along with a digital copy of your submission for future reference.

It’s fast, compliant, and perfect for anyone looking to take control of their tax affairs without hiring an accountant.

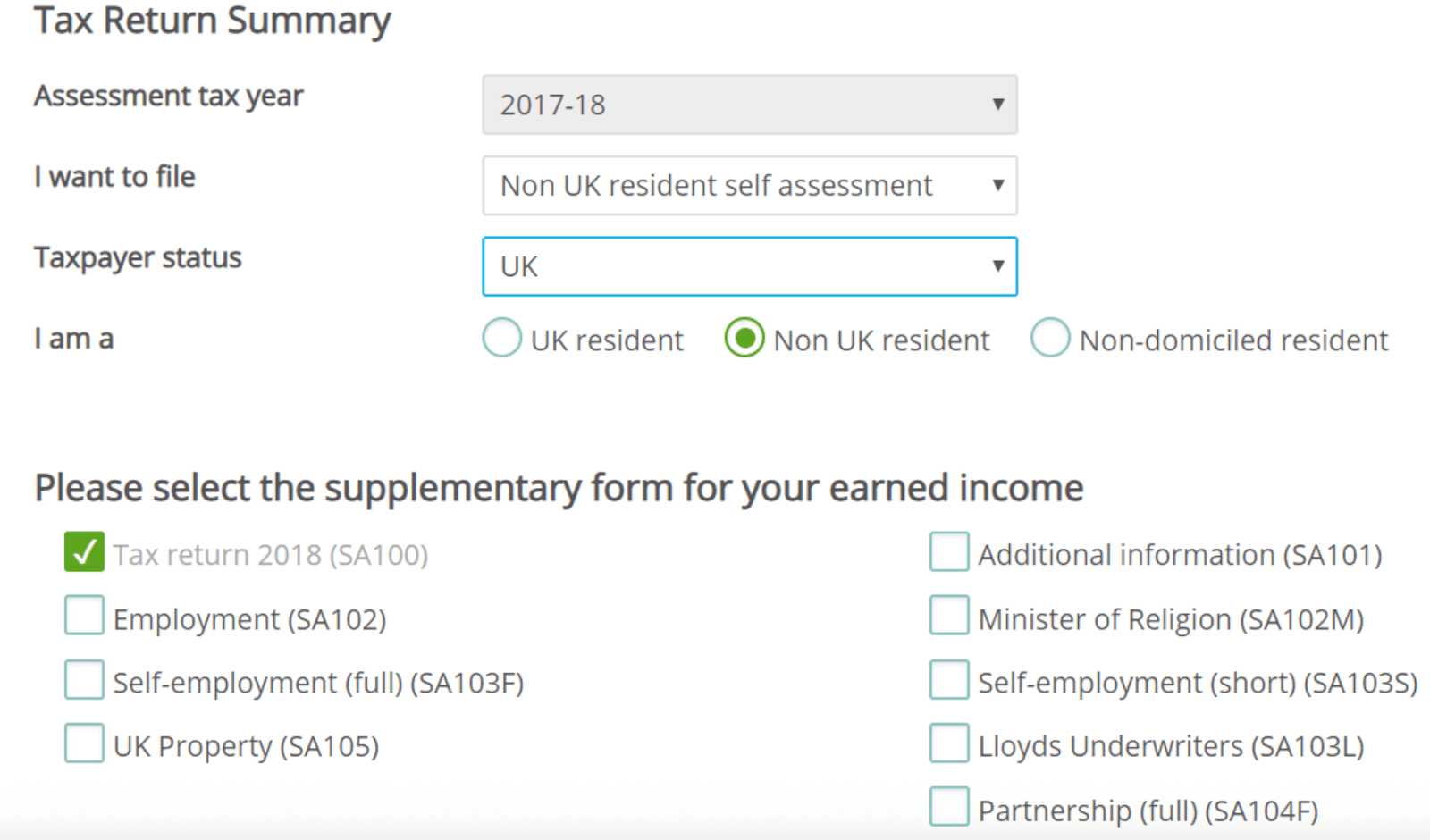

Non-Resident Tax Filing

For those living abroad but earning income in the UK, Basetax offers a non-resident tax filing service. This plan simplifies the complex process of declaring UK income while living overseas.

It helps users complete the SA109 form accurately and ensures compliance with HMRC’s non-resident tax obligations. The software automatically includes relevant deductions and double-tax relief options where applicable.

It’s an ideal option for expatriates, international freelancers, or investors with UK-based income sources.

Bookkeeping

Basetax’s free bookkeeping feature allows users to track income and expenses throughout the year without paying a penny.

You can connect your bank account, categorise transactions, and view real-time summaries of your business finances. This makes it easy to stay organised and avoid last-minute stress during tax season.

It’s particularly valuable for freelancers and sole traders who want to monitor profits, manage receipts, and understand their cash flow.

MTD VAT

As part of the UK government’s Making Tax Digital (MTD) initiative, all VAT-registered businesses must now file their VAT returns digitally.

Basetax makes this process seamless and completely free of charge. The system enables you to complete and file VAT returns directly to HMRC in full compliance with MTD regulations.

Users can record transactions, calculate VAT automatically, and submit their returns in minutes, no paperwork or manual uploads required.

2. Accountant Services

For users who prefer professional assistance or have more complex financial situations, Basetax offers a range of expert-led accountant services.

These are ideal for sole traders, limited companies, and startups who require deeper tax planning, financial advice, or full compliance management.

Every service includes personalised guidance from qualified UK accountants who understand HMRC’s regulations and work to ensure your returns are not only accurate but optimised for your situation.

Expert Assisted Tax Services

This service connects you directly with an expert accountant who will help you complete your tax return from start to finish.

For a flat fee of £199, you get a professional review, personalised advice, and complete filing support, ensuring your tax return is accurate and compliant.

It’s especially suited for individuals with multiple income streams, property income, or investment earnings who want the assurance of human oversight.

Accountant for Sole Trader

Basetax offers dedicated tax services for sole traders, covering everything from bookkeeping and expense management to annual self-assessment filing.

This service ensures sole traders remain fully compliant with HMRC rules while identifying deductions that reduce tax liability.

Your accountant will help you plan ahead, manage quarterly obligations, and prepare accurate financial summaries to support your business growth.

Accountant for Limited Company

Limited companies have unique accounting needs, and Basetax’s full tax and accountancy service caters to them comprehensively.

This includes company accounts, Corporation Tax filing, Companies House submissions, and detailed bookkeeping throughout the year.

The dedicated accountant assigned to your business provides continuous support, ensuring that deadlines are met and your financial records stay audit-ready at all times.

Business Start-Up (New Service)

Basetax has recently introduced a Business Start-Up service, aimed at helping entrepreneurs launch their ventures with financial clarity and compliance from day one.

This service covers everything from business registration and account setup to tax guidance and early-stage bookkeeping advice.

This guide provides step-by-step instructions for filing your tax return, completing MTD VAT returns, and recording your first transaction using Basetax.

Step-by-Step Guides: Making tax filing simple

Step-by-step instructions for filing your tax return, completing MTD VAT returns, and recording your first transaction using Basetax.

Before You Start

Ensure you have the following information:

- Unique Tax Reference (UTR)

- Landlord statements, summary of rental income and expenses

- Mortgage interest statement

- Bank statement

- P60/P45

Step-by-step process to file your tax return

Step 1: Open the Form- Click and open the appropriate tax form.

Step 2: Fill in Your Personal Information- Ensure you input your UTR correctly along with other personal details.

Step 3: View Your Tax Calculation- The system will calculate your taxes based on the provided data.

Step 4: Validate Your Data- Once you’ve reviewed your details, validate your data and make any necessary payments before submitting.

What Happens After Submission?

- After submission, HMRC will automatically verify your data.

- You will receive a confirmation email from HMRC within a few minutes (or up to an hour during busy periods).

- If you don’t receive this email, contact support via live chat or email.

Confirmation Email Example: “Thank you for sending the Self Assessment submission online. Your submission was successfully received on [Date]. It is now being processed. For more details, visit the HMRC website.”

Step-by-Step Process to File MTD VAT Return

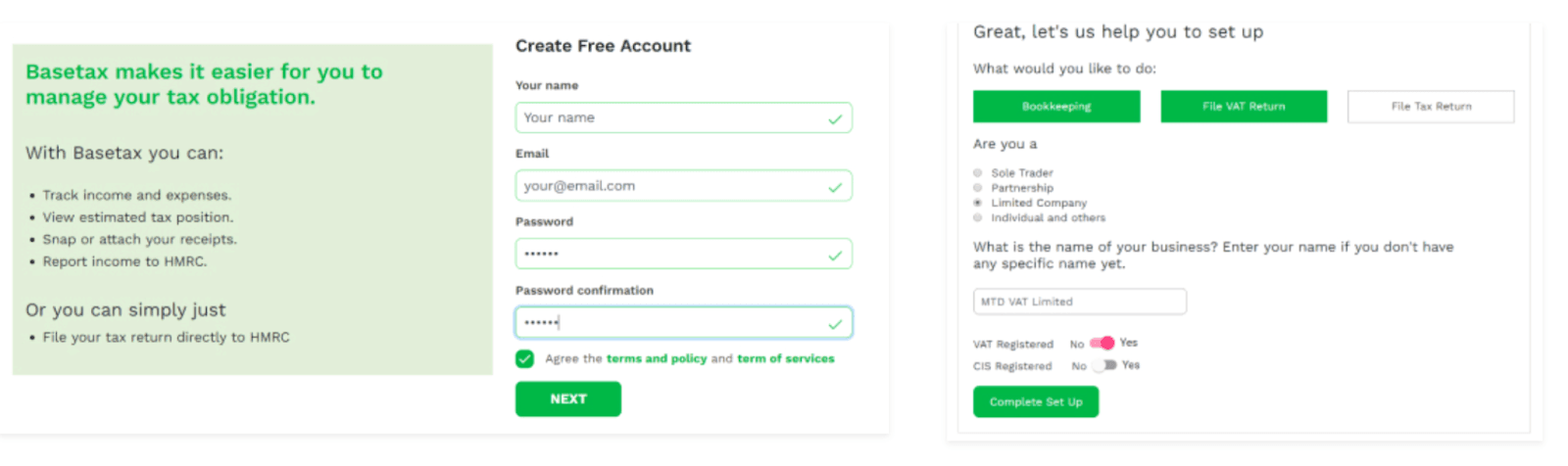

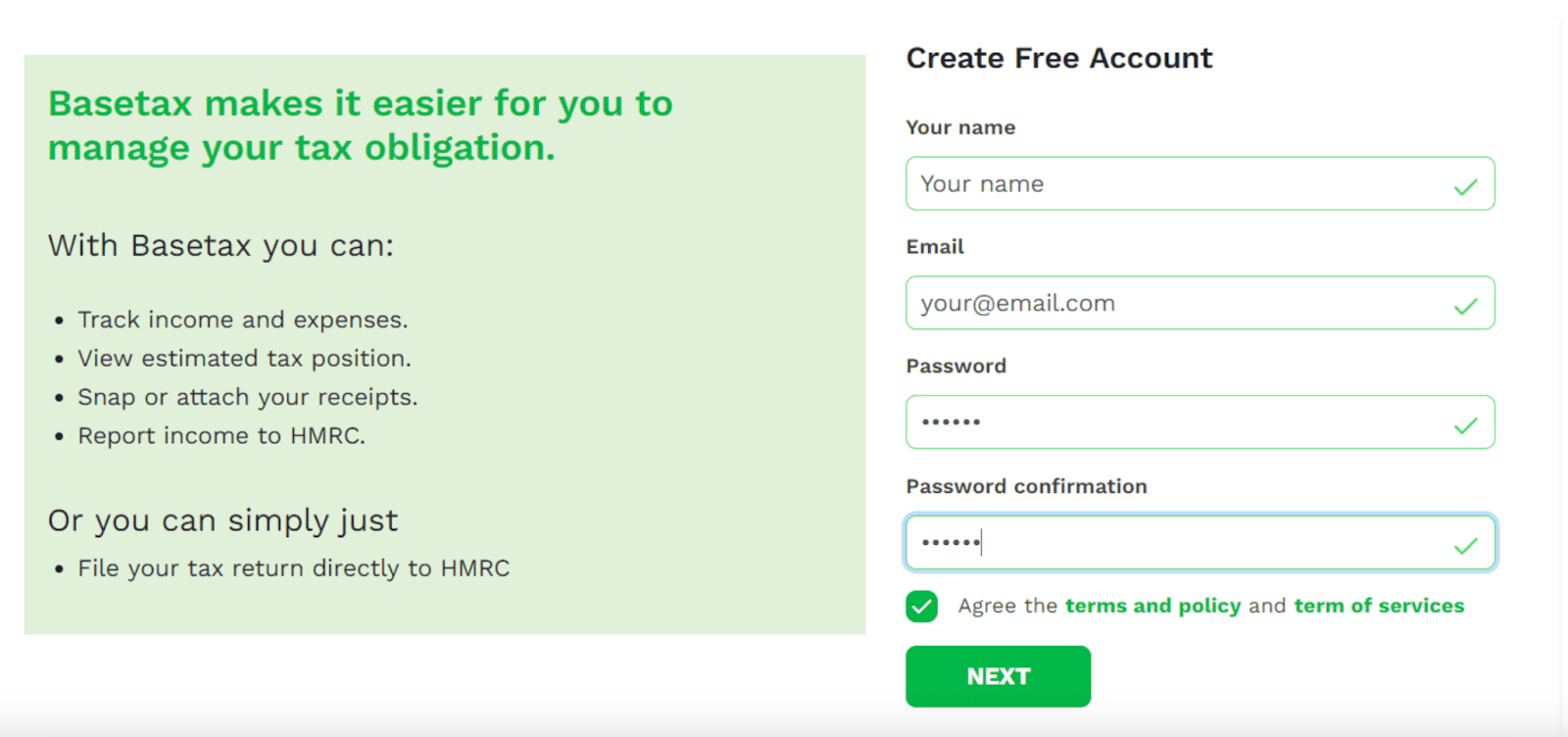

Step 1: Sign Up

Register on www.basetax.co.uk.

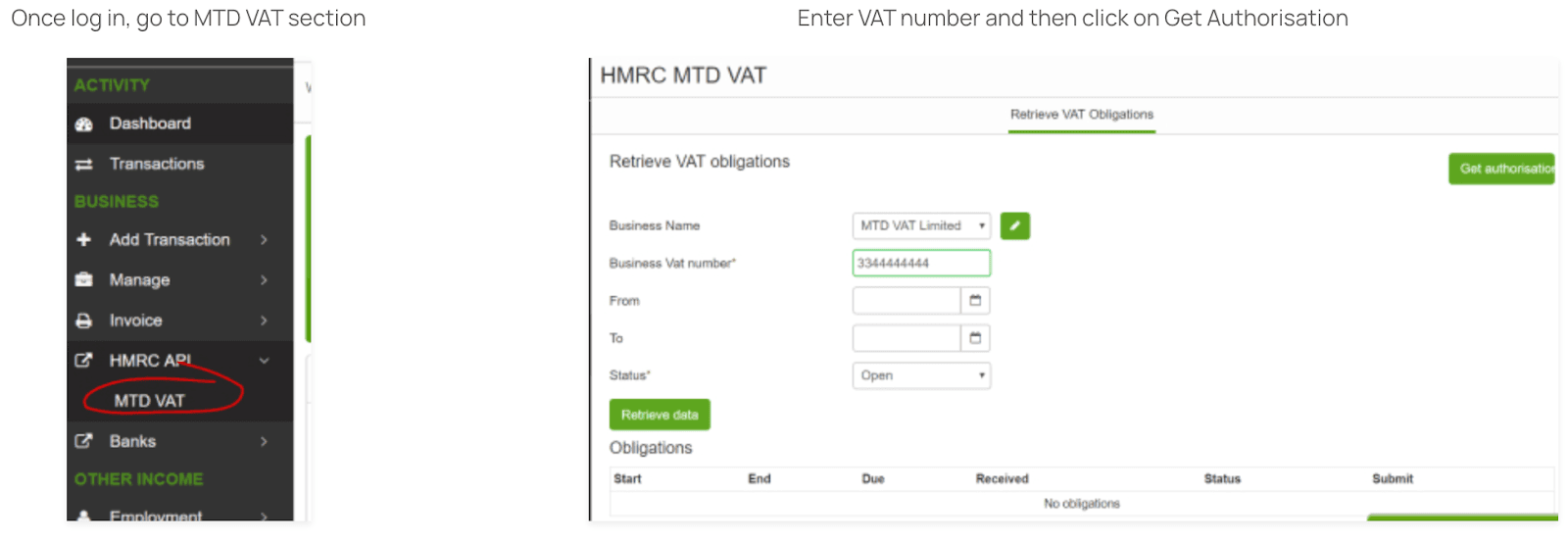

Step 2: HMRC Authorisation

- Log in and go to the MTD VAT section.

- Enter your VAT number and click on “Get Authorisation.”

- Log in to your HMRC account using your credentials.

Step 3: View & Open Obligation

- After successful authorisation, view your obligation period and click “Open” to submit.

Step 4: Load Transactions

You can either:

- Upload transactions from Excel.

- Manually input each transaction.

Step 5: Review VAT Return

Check all details and review the return before submission.

Step 6: Submit VAT Return

Once submitted, you will receive a confirmation reference from HMRC.

Bookkeeping Guide: How to record your first transaction

Step 1: Sign Up

Create an account on www.basetax.co.uk.

Step 2: Access the Dashboard

After logging in, ensure you’re in the correct tax year. You can add transactions either from the side menu or by using the ‘+’ sign.

Step 3: Enter Transaction

- Add income and enter the transaction details.

- If you don’t have a business set up, you can use your personal name.

Once the transaction is recorded, your financial summary will be updated. Attach any electronic files or invoices for future reference and potential audits.

Transparent pricing: Simple plans for every type of taxpayer

Basetax offers a clear, flexible, and transparent pricing structure designed to suit individuals, freelancers, sole traders, partnerships, and limited companies. Every plan is straightforward, with no hidden fees, no long-term contracts, and the flexibility to change or cancel at any time.

Key pricing options include:

- Free Plan

- Basic bookkeeping software for tracking income and expenses

- Raise invoices and view estimated tax

- Access to one year of financial data

- Users only pay if they choose to file a tax return with HMRC or submit annual accounts to Companies House

- Club Plan (£15/month + VAT)

- All features of the Free Plan

- Unrestricted access to prior year financial data

- Includes free filing of one online tax return

- Ideal for freelancers and small businesses who want continuity across multiple financial years

- Professional Plan (£25/month + VAT)

- Full accounting software support for sole traders and partnerships

- Track unlimited transactions

- Professional reports and invoice management

- Connect multiple bank accounts

- MTD VAT submission and mileage tracking

- Support from a qualified accountant for tax return review and compliance

- One-off Accountant-Assisted Services

- Individual or Non-Resident Tax Return

- Self-filing: £45 per return

- Assisted filing with a qualified accountant: £199 per return

- Sole Trader / Partnership Tax Services

- Accountant-assisted preparation, calculation, and filing

- Starting from £150 plus VAT

- Limited Company Services

- Full accounting and tax services, including payroll, VAT returns, corporation tax, and annual accounts

- Starting from £450 plus VAT

- Dormant company filing: £200 plus VAT

- Individual or Non-Resident Tax Return

Payment and Flexibility

- Pay monthly using all major credit and debit cards

- Annual subscription available: 12 months for the price of 10

- No set-up fees

- Cancel at any time with the ability to download financial data

Why Basetax Pricing Works

- Tiered plans to suit different needs, from freelancers to limited companies

- Transparent costs with no hidden fees

- Access to qualified accountants for professional support when required

- Flexibility to scale services as business needs grow

- Simple subscription model that aligns with digital tax management

By offering flexible subscription plans, one-off accountant services, and professional support, Basetax ensures tax management is easy, affordable, and stress-free. Users can choose the right level of service for their circumstances, giving them confidence that their finances and tax obligations are handled correctly.