Tax Filing and Compliance

Your tax filing - simplified

and always compliant

Automate your Tax Filing with Basetax

Simplify your tax process with real-time updates and expert guidance, ensuring compliance every step of the way

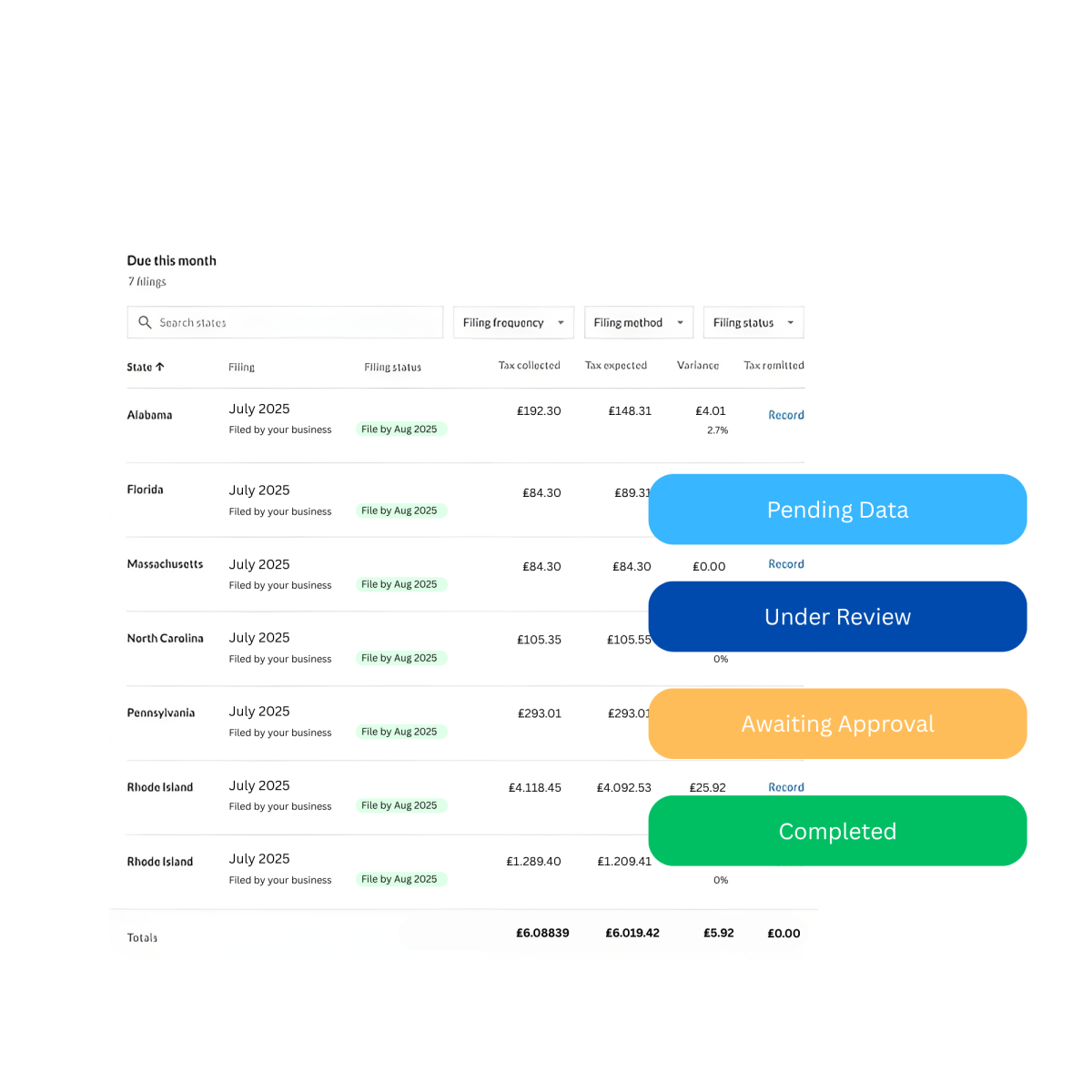

Real-Time Compliance

Track your tax filing status in real-time, from Self-Assessment to VAT returns, and ensure full compliance with HMRC requirements every step of the way

Dedicated Tax Support

Expert advice is always just a click away, ensuring your tax filings are accurate, timely, and in full compliance with regulations

Automated Tax Audits

Trust your data with automated audits, ensuring your tax filings are accurate and align with HMRC standards. Detect errors early with AI-powered anomaly detection

AI-Powered Tax Document Management

Our AI automatically extracts and categorises your tax-related documents, such as receipts and invoices, streamlining your workflow and reducing manual errors for more efficient tax filing

Effortless Tax Filing from One Platform

Manage your tax filings, HMRC submissions, and Making Tax Digital (MTD) compliance all from a single, AI-powered dashboard. Simplify your tax process and stay compliant with ease

Why Should You Choose Basetax for Tax Filing?

With the UK’s Making Tax Digital (MTD) initiative and quarterly income tax reporting for sole traders from 2026/27, the need for digital record-keeping is becoming essential. By embracing AI Tax Filing and Compliance, Basetax.ai—an HMRC-recognised platform- provides businesses with the tools to simplify tax processes, reduce errors, and stay ahead of regulatory requirements. Here’s why investing in AI-driven tax filing is a smart choice for your business

Automate and Simplify Tax Filings

AI-driven tax filing automates the entire process, from Self-Assessment to VAT returns. Basetax.ai handles everything from data extraction to submission to HMRC, ensuring that your taxes are filed accurately and on time, every time

- Save Time: Automate manual tasks such as data entry, tax calculations, and document management

- Reduce Errors: AI eliminates human errors by cross-checking data against the latest tax codes and compliance regulations

- Focus on Growth: Free up valuable time for strategic decision-making while AI handles your tax compliance

Stay Compliant with HMRC and MTD Regulations

With Basetax.ai, your business remains fully compliant with HMRC standards and Making Tax Digital (MTD) requirements. Automated real-time updates ensure that you’re always aware of changes in tax legislation, ensuring your filings stay up to date

- HMRC Compliant: Instantly file major tax forms, including SA100 and VAT returns, directly to HMRC

- MTD-Compliant: Basetax.ai ensures that your tax filings align with Making Tax Digital, reducing the risk of penalties for non-compliance

- Regulatory Assurance: Stay informed of changing regulations and deadlines, ensuring you're never caught off guard

Detect Tax Anomalies and Risks

AI isn’t just about processing data; it’s about analysing it. Basetax.ai uses advanced AI to detect discrepancies, identify tax risks, and alert you to potential errors or fraudulent activity before they become issues

- Anomaly Detection: AI scans your financial data for unusual patterns or discrepancies, helping you avoid costly mistakes

- Risk Mitigation: Proactively identify areas of concern in your tax filings, preventing underpayments or errors in reporting

- Peace of Mind: Trust that Basetax.ai’s AI-powered audit features catch potential issues before they affect your business

Real-Time Tax Insights and Reporting

Gone are the days of scrambling to understand your tax situation just before a filing deadline. With Basetax.ai, you gain real-time insights into your tax liabilities, potential deductions, and filing statuses

- Instant Tax Calculations: Get real-time updates on your tax obligations and deductions, making sure you're always prepared

- Comprehensive Tax Reports: Easily track your financial health, forecast future tax liabilities, and identify opportunities to optimize your tax strategy

- Informed Decision-Making: Use AI-powered reports to make proactive tax decisions and plan your finances with confidence

Scalable Solution for Growing Businesses

Whether you're an individual, small business, or landlord, Basetax.ai adapts to your unique tax filing needs. From self-employed individuals to multi-partner businesses, our AI-driven platform scales with your growth, ensuring you’re always prepared for the next phase of your business

- From Sole Traders to SMEs: Whether you’re a freelancer, small business, or partnership, Basetax.ai has the tools you need

- Tailored for Landlords: Manage property income and expenses easily, with tax filing support for residential and commercial landlords

- Flexible for Future Growth: As your business evolves, Basetax.ai evolves with you, providing scalable tax solutions that meet your growing needs

Take Control of Your Tax Filing with Basetax

Investing in AI Tax Filing and Compliance means choosing a smarter, more efficient way to manage your business taxes. With Basetax.ai, you not only automate and streamline tax filings but also ensure full compliance with HMRC standards. This allows your business to focus on what matters most, growth, profitability, and long-term success.

Start Using Basetax.ai Today and transform how you handle tax compliance with intelligent automation and expert support.